If you’re eligible for a VA loan and are wondering if it is the best loan type for you, we’ve outlined some helpful scenarios below to help you understand your options and when a VA loan is best.

“Hi. I am eligible for a VA loan, now living in Missouri after leaving the military. My family says I should get a VA loan for my upcoming home purchase since no down payment is required. My realtor says sellers don’t like them. How do I decide which loan option is best for me?”

Firstly, thanks for your service. As you’re discovering, there can be pros/cons for various loan programs. Let’s look at both for VA loans:

VA Loan Pros

No down payment in most cases:

VA loans offer eligible veterans 100% financing, unlike other mortgage options. Sellers can also pay buyers’ closing costs, or even pay off some of their buyers’ debt, subject to guideline limits.

No monthly mortgage insurance costs:

VA loans also do not require mortgage insurance (unlike conventional loans with down payments under 20% or FHA loans). Why is this a big deal? Depending on loan specifics, including a host of factors such as down payment %, credit scores, purchase price, etc, the PMI on a conventional $300,000 purchase can be as much as $378/month (or more, in some cases!)

Assumable:

VA loans are also assumable, which can be a substantial benefit, especially for anyone buying a home secured by a VA loan originated during 2020-2022’s record low interest rates. Chris Maloney with BOKF writes, “Breaking that down across the three segments for how much of the universe is paying 3% or less on their mortgages as of the end of May, for conventional 30-year borrowers that comes to 32%, for FHA 30-year borrowers 21.9% and for VA borrowers 50.7%.” Now we know why assumability matters: Over half of all current VA loan holders have rates under 3%! If you’re a VA home buyer and manage to find a veteran-owned property for sale with current mortgage rates in the 2’s, you’ll save oodles (a technical industry term) on your new mortgage. How much?

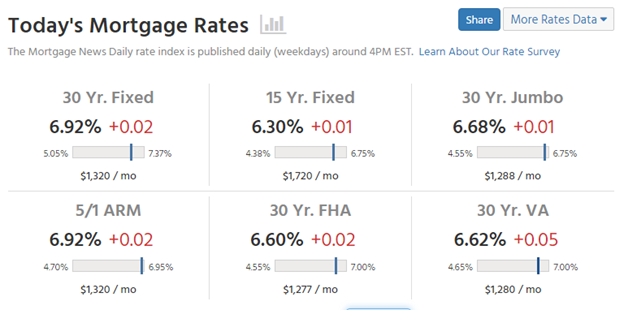

On a $300,000 loan, using MortgageNewsDaily.com’s current average VA rate of 6.62%, the principal and interest (P&I) payment would be $1920/month. If you’re lucky enough to buy a home with an existing VA loan at 2.75% and assume that loan, your P&I payment (depending on how long the current mortgage has been in place) could be as low as $1251/month! If you’re selling a home with a VA assumable mortgage that’s substantially below current interest rates, it’s likely your potential buyers will offer more than on a similar home without a low rate, assumable mortgage.

Streamline refinance eligible: VA loans can also be “streamline refinanced”, a simple process compared with typical refinances. When rates drop, existing VA borrowers can reduce their interest rates without an appraisal or concerns about their debt-to-income ratios. There are HUD imposed restrictions (cannot refinance prior to making 6 months’ payments, must reduce interest rates by a minimum of .5%, etc), but overall, VA borrowers’ average rates are lower than conventional, FHA, or USDA loan borrowers.

VA Loan Cons

Property Condition:

As your agent noted, some home sellers may be reluctant to accept offers involving a VA loan. The typical concern is that VA appraisals are more detailed than conventional loans, and the home seller must repair/replace any items the appraiser cites as not meeting VA requirements. A seemingly inconsequential item such as peeling paint on a deck might not matter to you, but if the VA appraiser cites it as a deficiency, the seller must remedy it (and appraiser return to verify the repair) prior to final loan approval.

Funding Fee:

We touched on “no mortgage insurance on VA loans” earlier, but there’s a caveat involved. VA loans require, in most cases, a “funding fee”, which is added to the loan balance. As with mortgage insurance, the amount of the funding fee depends on the transaction. Veterans with a VA disability rating (regardless of its degree) are exempt from funding fees, but those without will pay a 2.3% (of loan size) funding fee with down payments under 5% if they’re first time VA borrowers. “Subsequent Use” VA borrowers (those who’ve already bought a property using a VA loan, now buying another, depending on down payment) can face a hefty 3.6% funding fee, as shown on VA’s website: https://www.benefits.va.gov/HOMELOANS/documents/circulars/26-23-06-exhibita.pdf

Who should and shouldn’t utilize a VA loan?

Who should:

In general, any eligible veteran with a VA disability rating would benefit the most from a VA loan, as would those who don’t have (or don’t care to make) a down payment. Veterans with “less than outstanding credit scores” also find VA loans more beneficial, since credit scores influence VA interest rates far less than on conventional loans.

Who shouldn’t:

Veterans who have down payment funds (particularly if 20% or higher), great credit scores, and low debt ratios should compare conventional and VA loan options, since they will be paying a VA funding fee that will be thousands of dollars. Home buyers in a highly competitive market (which areas aren’t these days?) often find sellers more amenable to conventional loan offers over VA offers, which is another reason to consider not opting for a VA loan.

As always, consult your mortgage professional for more exact details. They’ll be able to give you specifics and offer their recommendations.