“I’m looking at buying a vacation property in Michigan. What loan(s) should I consider?”

Congratulations on your upcoming purchase! Your question is highly apt, as second home financing has changed dramatically over the past several years. Historically, Fannie Mae/Freddie Mac viewed second (aka: vacation) homes as similar to primary residences, and their interest rates were virtually the same. Since 2021, they’ve added substantial pricing adjustments (translation: significantly higher costs/rates) for these loans.

The bottom line is that you’ll need a down payment of at least 10% for a vacation home, and 25% or higher to obtain the best rates. Note: those rates will still be higher than for a corresponding primary residence.

How much more do second home loans cost?

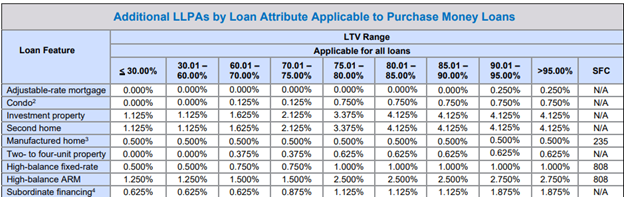

Fannie/Freddie currently adjusts the pricing on second home loans identically to investment properties. That means you’ll pay a whopping 4.125% surcharge ($4,125 on a $100,000 loan!), typically reflected as both upfront points and a higher rate for a second home purchase mortgage with less than a 20% down payment. At 25% down, the surcharge is still 2.125%. A 40% or higher down payment lowers it to 1.125%. Yearning for more details? See Fannie Mae’s pricing adjustment chart below!

What else do you need to know about getting a vacation home mortgage?

Are there any restrictions on how I use a vacation home? I’d like to generate some rental income using Airbnb or VRBO to help offset my payment.

Fannie Mae/Freddie Mac have minimal (and surprisingly low) requirements for second homes, but it’s still important to understand them.

Second homes must be in a different area than a primary residence

You can’t buy a second home in the same neighborhood you currently live in. While there’s no hard and fast distance requirement, in general, there must be logical differences between the homes. A Chicago primary residence condo and a western Michigan lakeside vacation cabin would definitely be considered different markets. A Detroit single family primary residence and a nearby, similar single family home in an adjoining suburb most likely wouldn’t. Most veteran loan officers ask their clients to write short letters of explanation if it’s likely an underwriter would question why the new property would qualify as a second home.

Must maintain control of the property

While you can rent a vacation home on a short-term basis (Airbnb, VRBO), you must retain control over it, so you cannot use a management company to rent it for you. Timeshares are not eligible for second home (or any conventional) financing.

Can’t use projected rental income to qualify for the loan

Your debt ratios (including the total second home costs, including mortgage payment, taxes, insurance, and applicable HOA costs) must meet Fannie/Freddie requirements. Using projected rental income is not allowed, unlike investment property purchases.

Must be suitable for year-round occupancy

That charming cabin, in the remote Upper Peninsula might be just what you’re looking for, but if it has no heat, or is on an unmaintained road that’s routinely unpassable during winter months, it’s not eligible for a Fannie/Freddie loan. You don’t have to live in it during any specific season but must have the ability to!

Our loan officers are ready to answer your questions and provide expert guidance for you!