As always, our goal is to provide tips for successfully navigating the mortgage process and to educate our readers on mortgage rates, the factors impacting them, and how to evaluate loan options.

“Help! I’m in Missouri and looking for my first home loan. I haven’t found a house yet but am planning to make an offer as soon as I find one that meets my family’s needs. My realtor said I should get “Good Faith Estimates” from lenders now, so I can compare their costs and rates. I’ve also heard about “Loan Estimates” and “Cost Worksheets”. Are these all the same things? What do they mean? This seems quite confusing.”

Welcome to the joys of loan disclosures! You’re absolutely correct, these can be confusing, but they don’t have to be. Let’s talk about them!

Loan Estimates

Prior to October 2015, Good Faith Estimates and Truth In Lending forms were required on residential mortgages. While these standardized disclosures were used for several decades, some borrowers found them confusing, so the Consumer Finance Protection Bureau (CFPB) revised them, combining the Good Faith Estimate and Truth In Lending forms into “Loan Estimates” (provided at application) and “Closing Disclosures” (which mirror the LE but reflect the final details of the transaction, rather than estimating some costs).

Loan Worksheets

Good Faith Estimates haven’t been used since 2015. “Loan Worksheets” are commonly utilized by lenders as more generic, “unofficial” loan breakdowns for borrowers who may not have a specific property in mind, know a final purchase price or loan size, etc.

Legal Binding of Loan Estimates vs. Loan Worksheets

While Loan Estimates are legally binding on lenders (meaning costs must be disclosed accurately and lenders may be liable for some cost changes), other estimates (“loan worksheets” or “cost breakdowns”) are not.

Lenders must provide borrowers with Loan Estimates within 3 business days of a full loan application. “A full application” means you’ve provided your SSN, income, purchase price, estimated property value, loan size, and property address to a lender. It’s also important to note that “full applications” also require lenders to issue underwriting approvals/denials within 30 days, unless borrowers request to withdraw their loans.

Note: Lenders cannot (per CFPB regulations) REQUIRE any documentation (such as proof of income or assets) from borrowers before they provide a Loan Estimate. That said, your lender may ASK for your documentation in order to accurately assess your income/assets from the start of the process. While it’s your option to provide these in advance or not, doing so helps your lender verify the verbal info you’ve provided, which is particularly important for self-employed borrowers, those with rental property income, or incomes that include job changes, overtime, commissions, or bonuses. The last thing you (or your lender/realtor/home seller) want is to go under contract on a house, then find out your income isn’t sufficient for a loan on it!

“What items on the Loan Estimate are binding on the lender?”

Loan Estimates itemize ALL anticipated transaction costs, whether lender related or not. “Non-lender” costs (also known as “third party fees”) are things like appraisals, title fees, homeowner’s insurance premiums, and transfer/state costs. Lenders may be responsible for some costs that are under-disclosed on Loan Estimates (such as disclosing $400 for appraisal fee if it’s really $800), unless there is a “changed circumstance” such as changing the loan size/purchase price/home value.

Lenders understandably want to avoid paying third party costs, so may “over-disclose” them on Loan Estimates. An example would be disclosing the state transfer taxes on a home purchase, even if the seller typically pays those costs. The bottom line is that Loan Estimates often show higher costs than Closing Disclosures. Ask your loan officer which of the fees on your Loan Estimate are precise (versus third party costs that may be estimated high) and yours (versus the seller’s) responsibility.

“I got a Loan Estimate from my lender Monday and let him know Thursday I wanted to move forward. He’s telling me rates went up since Monday and I’ll now have a higher payment. Is this a bait and switch move?”

While Loan Estimates essentially guarantee certain loan costs, interest rates are subject to change until you instruct your lender to lock your rate. Interest rates change, just as your neighborhood QT’s gas prices do. When bond markets are volatile, rates can even change multiple times in a day. Your lender isn’t doing a “bait and switch” any more than QT is when they raise gas prices.

Locking Your Rate

“I’m no bond market guru, how am I supposed to know when to lock my rate?”

Anyone who purports to know what rates “are going to do” is being disingenuous. IF they did know, they’d be making millions trading bonds, rather than writing loans or selling real estate. The decision to lock your rate versus “floating” it (meaning the rate is subject to change) is a personal one, based on your risk tolerance and circumstances. If you’re losing sleep wondering whether rates will rise while your loan is in progress, you probably have a low risk tolerance and should look at locking. If your debt ratios are high, and you might not qualify if rates rise, you should lock. If you crave uncertainty and don’t mind the prospect of a higher payment, you may be OK floating your rate. Ask your loan officer for his/her thoughts, and whether they have “float down” options if you lock the rate, then rates subsequently drop.

“I heard lenders are now charging higher fees for some borrowers, depending on their debt-to-income ratios. What’s the deal on that, and how can I know if I’ll have the higher fees?”

FHFA (the Federal Housing Finance Agency) oversees lending and sets the various fees (also called Loan Level Pricing Adjustments or LLPAs) which apply to Fannie Mae and Freddie Mac loans. LLPAs are intended to account for loan risk factors (such as whether home will be occupied by the buyer, down payment %, property type, and credit scores). FHFA announced in January they intended to add a new LLPA (additional loan cost) for borrowers with debt ratios over 40%. Lender feedback and social media outrage over the new fee led the FHFA to delay the increase until August: (https://www.fhfa.gov/Media/PublicAffairs/Pages/Statement-from-FHFA-Director-Sandra-Thompson-on-Upfront-Fees-Based-on-Certain-Borrowers-DTI-Ratio.aspx) in March, and it was eliminated altogether May 10th: (https://www.fhfa.gov/mobile/Pages/public-affairs-detail.aspx?PageName=FHFA-Announces-Rescission-of-Enterprise-Upfront-Fees-Based-on-Debt-To-Income-Ratio.aspx).

The bottom line for borrowers? Ask your loan officer what the LLPAs are for your loan, and if there are simple options for reducing them. Examples might be increasing your down payment, raising your credit scores, or purchasing a single-family home rather than a condo. It’s ironic that these FHFA imposed costs are NOT shown on Loan Estimates or Closing Disclosures, despite applying to all Fannie/Freddie loans!

Recent Mortgage Rate Trends

“How have interest rates been lately? Did the Federal Reserve’s latest rate increase impact mortgage rates too?”

As we’ve previously discussed, the Federal Reserve doesn’t set mortgage rates, but their economic outlook and short-term interest rate changes inform mortgage interest rates. The Fed raised their “overnight” rate by .25% on May 3rd, but signaled that, after 10 consecutive hikes, they may be ready to pause future increases. The Federal Reserve has been raising rates to slow consumer demand and inflation, which has waned recently but remains well above the Fed’s stated goal of 2%.

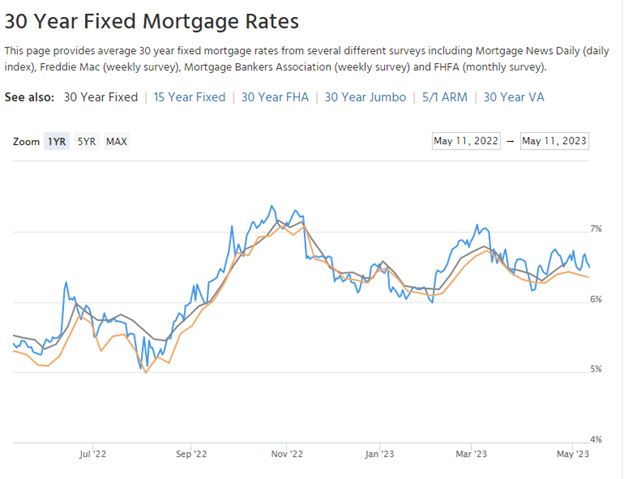

As the following chart, (courtesy, as always of MortgageNewsDaily.com) shows, 30-year fixed mortgage rates have been fairly stable since March, with a high near 7% and currently in the mid 6’s. The blue line is Mortgage News Daily’s average rate compilation from leading lenders, and typically the most accurate. The orange line is Freddie Mac’s weekly rate survey, which we’ve previously discussed is often outdated before it’s even released, and the black line is weekly data from the Mortgage Banker Association.

“Shoot, I really wanted to get a rate under 5%. When can we expect to return to the awesome levels we saw from 2020-2022?”

Short answer: We can’t. Longer answer: The Covid-19 pandemic incited unprecedented economic uncertainty, which led to interest rates far lower than the norm. Those who were fortunate enough to snag rates in the 3’s (or even 2’s!) may be bragging about their loans for a LONG TIME. They may also be reticent to sell their homes (paying off low-rate mortgages) with current rates roughly double pandemic lows!

“Should I just give up on buying a home, or wait until I can get a rate under 4%?”

At the end of the day, the decision to buy a new home is based on multiple factors. While rates are part of that discussion, other factors (especially your family’s needs!) are more important. If your family of 7 is living in an 800 square foot condo, you likely need more space, whether interest rates are in the 6’s or 3’s. Waiting to move “until rates drop” probably isn’t going to sit well with your family. Rather than focusing solely on interest rates, look at your current housing expense, your projected payment’s affordability, and how well the new home suits your situation compared with your current one. As the old expression goes, you “date the rate, but marry the house.” There are no prepayment penalties on most mortgages, and the possibility of refinancing to a lower rate (even if not near pandemic lows) is typically an option.

Speak to a Loan Expert About Your Mortgage Questions

Thanks for reading this edition of our blog. We hope it’s been informative and helpful. Our loan officers are ready to answer your questions and provide expert guidance for you!