Whether you’re a first-time homebuyer or looking to purchase a vacation home, buying a house is an exciting time. However, it can be a bit confusing when it comes to the financial aspect.

As a prospective homebuyer, you’ll notice there are many loan options available, and two types of mortgages to consider are Department of Veterans Affairs (VA) loans and conventional loans. If you’re eligible for both, it can be tricky to decide which one you should choose.

If you’re considering whether you should get a VA loan or a conventional loan, Homesite Mortgage can help walk you through the process. Check out our guide to get started.

1. Eligibility

One of the most notable differences between a VA and a conventional loan is the eligibility requirements.

Who Is Eligible for a VA Loan?

A VA loan is designed to help active service members and veterans of the armed forces become homeowners. This kind of loan is also often available to surviving spouses and family members. A Veterans Affairs loan is a type of government or non-conforming loan. While the Department of Veterans Affairs doesn’t issue the mortgage itself, it guarantees the loan when issued through a private lender.

The VA has various eligibility requirements for loan seekers, depending on when and how they served in the military. For example, an eligible loan recipient must be currently serving or have been honorably discharged. Read more about the details of VA loan eligibility on the department’s website.

Who Is Eligible for a Conventional Loan?

Unlike a VA loan, prospective homeowners don’t have to meet as many requirements to determine their eligibility for a conventional loan. Instead, your lender will consider more standard factors like your credit score, income and whether you have enough money for your down payment.

This is unlike a conventional loan, which is a conforming loan. These loans can be sold to mortgage buyers and aren’t guaranteed or insured by the government. Both the prospective homebuyer and the property will have to qualify for this loan.

2. Requirements

It’s important to keep in mind that there are also different loan requirements for a VA loan and a conventional loan. The main difference between a VA and a conventional loan is what kind of residence it can be used to purchase. Even if you meet the eligibility requirements for both, the kind of property you intend to own can determine which loan would be best for you.

VA Loan

If you meet the eligibility requirements, you’ll be able to use a VA loan to build, purchase or refinance a primary residence. This loan can’t be used for a second vacation home or rental property.

Conventional Loan

With a conventional loan, you’ll have more flexibility. Along with using this loan for a primary residence, it can also be used for purchasing a second home like a vacation home, investment home or even rental property.

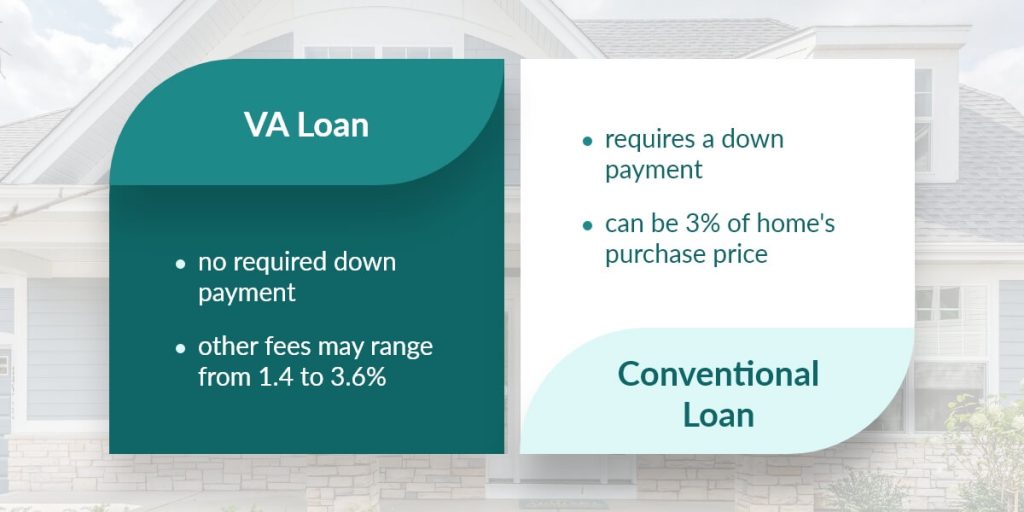

3. Closing Costs and Down Payments

There are a few differences between what you’ll be required to pay for either loan.

VA Loan

One of the benefits of a Veterans Affairs loan that attracts many prospective homebuyers is the fact that it doesn’t require a down payment. If your credit score is low, though, you may need a small down payment.

While there are no minimum down payment requirements, you may have to pay for other fees like VA appraisal fees, a credit check and closing costs, which could range from 1.4 to 3.6%.

Conventional Loan

A conventional loan will require a down payment. The amount can vary based on factors like the type of property you’re interested in and your personal finances.

The required amount can be as low as 3% of the home’s purchase price. Additional fees can vary but most likely will include an origination charge and closing costs. If your down payment is less than 20%, you’ll be required to pay private mortgage insurance.

Other Key Loan Factors to Consider

Before making a final decision, consider a few other factors:

- Due to differences in down payments, closing costs and other fees, your monthly payment could vary between a VA and a conventional loan even when borrowing the same amount.

- If there are multiple offers on a home, buyers who have conventional financing may get preference from the seller.

- Both VA and conventional loans usually require an appraisal, but there will be different rules and regulations for each. You can expect the VA appraisal to be a little more strict.

- Some homeowners who have a VA loan may qualify for streamlined refinancing. This can help you take advantage of a lower rate and a quicker closing.

When to Choose a VA Loan

Most of the time, if you meet the eligibility requirements for a VA loan, that will be your best option. This is especially true for prospective homebuyers who may not be in the best financial situations.

If you don’t have enough funds saved up, you won’t have to worry about having to put any money down. Also, if your credit score is less than ideal, you still have a chance of qualifying for a Veterans Affairs loan. With this loan, you can also keep your overall financing down by not having to pay any mortgage insurance premiums.

When to Choose a Conventional Loan

Sometimes, a conventional loan is the way to go. If you have enough funds to put at least 20% down, you’ll be able to avoid paying mortgage insurance when you purchase the home.

There’s also the possibility that your offer will be accepted more readily if you and several others are bidding on a home. With a VA loan, appraisal problems can arise, so having enough to put down with a conventional loan can increase the chances that your offer is accepted.

Speak to a Loan Expert to See Which Loan Is Best for You

At Homesite Mortgage, we can provide the loan you need to make your dream home a reality. We offer fixed- and adjustable-rate conventional loans and VA loans. Whether this will be your first home or your fifth, we offer below-market interest rates and low closing costs.

We’ll walk you through the benefits of a VA loan and a conventional loan and help you determine which is best for your specific scenario. We’ve designed the entire process to be quick and easy. In fact, you can expect to close your loan in as little as 18-20 business days.

Experience exceptional customer service and support from start to finish. Reach out today to get approved in as little as 24 hours.