Our goal is to inform and educate you on the data and events influencing mortgages, rates’ outlook, and tips for navigating the loan process.

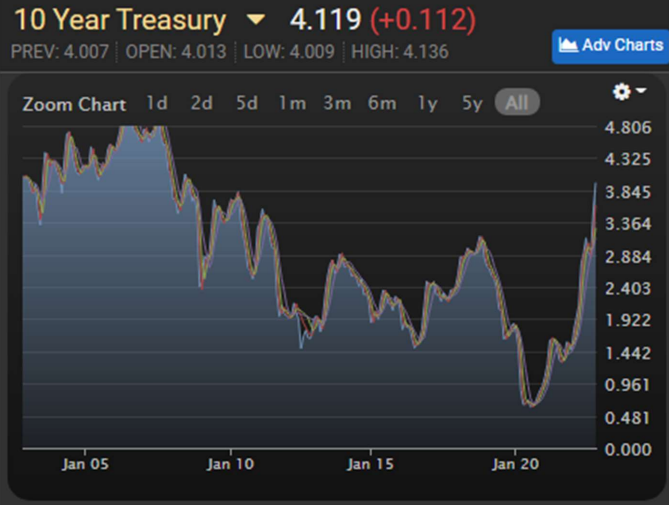

2022 has seen an unprecedented rise in interest rates. Ten-year Treasury yields (which mortgage rates typically follow) were near 1.7% in October of 2021. Where are they now? Over 4.1%, per the chart courtesy MBSLive.net below:

If we look at the longer-term chart (below), we see that treasury yields

are now the highest since 2007:

In simpler terms, it’s been 15 years since we’ve seen yields this high.

Why do treasury yields matter to mortgages?

10-year treasury yields are a common (and apt) proxy for mortgage rates, since most mortgages are in force for under 10 years, even if written as 30-year loans. People typically move, refinance, or simply pay off their mortgages well before 30 years pass.

Since treasuries are guaranteed by the federal government, they are considered “risk free” investments, with one caveat: inflation.

Why does inflation matter to mortgages?

We’ve all seen climbing prices this year. The Fed has been ratcheting up its overnight rate (more on this later) to slow the economy, reduce demand and hopefully ease inflation.

Most US mortgages have fixed interest rates. Bond investors (whether they buy bundles of mortgages called “mortgage-backed securities” or Treasuries) want returns that surpass inflation plus provide additional income. When inflation, regardless of the cause, rises, bonds are less attractive investments until rates rise enough to offset inflation.

When prices are rising at 7%+ levels, there’s little incentive to buy bonds providing returns well below that, implying rates may rise further. Would you want to loan someone money at 5% interest if you knew inflation was higher? Not likely!

Does the Federal Reserve determine mortgage rates?

Short answer: NO. The Federal Reserve sets its overnight rate (the interest banks pay to borrow money overnight). When you hear “the Fed raised rates .75% today”, it means the overnight rate rose, NOT Treasury yields/mortgage rates.

However, the Fed also puts out Fed Statements at their 8 annual meetings, even when they don’t change the overnight rate. These Fed Statements provide guidance on the Fed’s economic outlook, which investors dissect for clues on future Fed policy. When Fed Statements reference inflation as a concern, investors demand higher bond returns and rates rise.

Just how much have mortgage rates risen this year?

In early November 2021, 30-year mortgages carried an average interest rate just over 3%. The average today? An eyepopping 7.37%!! To put this historic rise in context, a $300,000 30-year loan at 3% has a payment of $1,264/mn. At 7.37% it rises to $2,071!! Is it any wonder that home sales are down, refinances are down far more, and homebuilder sentiment is tanking as well? Here’s a chart of rates for the last year, courtesy MBSLive.net:

“You mentioned Treasury yields inform mortgage rates. Those yields

rose around 2.4% in the last year, but mortgage rates have risen over

4% in the same period. What is the deal?”

Mortgages are bundled into Mortgage Backed Securities in rate “buckets”, composed of loans with similar interest rates. When rates are stable, investors and lenders can confidently access loans’ value, anticipated interest income, and expected loan duration. This predictability allows them to lower their profit margins while still feeling comfortable they’re making money.

When rates rise from record lows to multi-decade highs in a year, investors don’t know how long the loans they buy will be in force (loans closing at 7%+ are vastly more likely to refinance down the line than those at 3%), and lender pricing suffers. This affects borrowers in two ways: Higher rates and higher costs. Since investors aren’t willing to pay as much for loans written at the highest rates since the 2000’s, lenders’ profits increasingly come from their customers via origination costs. This is especially the case for borrowers with risk factors that carry Fannie Mae and Freddie Mac pricing adjustments, such as credit scores under 740, investment properties, second homes, cash out refinances, and condos.

We’ll touch more on this in coming editions, but some scenarios have pricing adjustments that can total as much as 5%! (extra cost to the loan, in the form of upfront points). Bottom line? It may make more sense (or be your only option!) to pay points on your new mortgage now, compared with the bulk of the last 20 years, when most loans did not involve origination points.

Rates have risen so fast, they MUST be ready to drop back just as

quickly, right?

While it’s tempting to presume that could happen, we need to realize the events that led to mortgage rates under 3% were unprecedented.

We hadn’t faced a worldwide pandemic in a century! Let’s face it, sub $2/gallon gas and interest rates under 3% are the exceptions, not the rule.

Conclusion: The “pandemic special” ridiculously low interest rates we saw from summer 2020- fall 2022 are in the rear-view mirror. Don’t plan on seeing them again anytime soon, if ever.

What other factors influence mortgage rates?

“Inflation is bonds’ arch enemy; volatility is inflation’s henchman.”

Lenders set their pricing each morning, based on bond market demand and movement. Predictable, minimal movement allows them to price more confidently and aggressively. Bond markets have been the opposite of “predictable and consistent” lately, leading lenders to price cautiously. In addition, when markets are volatile, lenders may update their rates during the day. If you get a rate quote Monday at 10 AM and call back to accept it at 4 PM, don’t be surprised if rates have already changed!

I’m home shopping, and already have a pre-approval. What should I

do differently in a rising rate environment?

Mortgage lenders issue pre-approvals based on the current loan parameters (credit scores, interest rates, etc) at the time. You might have gotten a pre-approval and payment projection from your banker last month, or last week. Rates, however, have risen substantially since then, meaning your approval and payment projection may no longer be accurate.

It’s critical to stay in touch with your loan officer and to ask him for updated projections before writing any offers. Ask your lender what the updated payment looks like. The awesome houses that fit your budget in September may no longer work, if your debt ratios were tight based on now unavailable rates.

I’ll just wait until rates drop, then look for a house. That’s the smart

move, right?

If we were all psychic, the world would be a wonderful place, but we’re not! While affordability is a valid factor in any home purchase, trying to time interest rates is risky at best. The author (a 22- year mortgage lender) has seen many borrowers “wait for now” on their refi or purchase “since rates will come back down soon” only to find they missed their opportunity. “Marry the house, date the rate” is a valid expression here. It means, first and foremost, the house you buy must meet your needs and budget.

Beyond that, there’s always the option to refinance and lower your payment down the line, presuming rates cooperate. Your situation (the state you live in, your loan size, credit scores, income, etc) also determine if/when refinancing may be viable.

We hope you’ve enjoyed reading this edition and learned some useful information. If you have additional questions, our loan experts can help answer your home mortgage questions.