As always, our goal is to inform and educate our readers on mortgage rates, the factors impacting them, and provide tips for successfully navigating the mortgage process.

Mortgage Rates

I heard that rates have dropped compared with December. How has 2023 been for mortgages so far?

We saw 10-year treasury yields (the easiest proxy for borrowers to track mortgage rates) just under 3.9% as 2022 ended. Since then, those yields have dropped nearly .5%, and mortgage rates improved substantially as well. Here’s a 30-day chart (all charts/data courtesy MBSLive.net) of treasury yields:

With a significant drop in treasury yields, are we headed back to rates in the 3’s anytime soon?

While nothing would please borrowers and lenders more than a quick return to mortgage rates under 4%, that’s highly unlikely to happen. The Fed is still on course to continue raising their overnight rate (which doesn’t impact mortgages directly, but guides the economic expectations that do), inflation is still considerably above the Fed’s stated goal of 2%. Also, unlike 2020-2022, Covid-19’s economic uncertainty is far less of an unknown factor.

What are the recent inflation trends in 2023?

The US Bureau of Labor Statistics releases inflation data monthly. There are several variations, but the most pertinent in our case is CPI (Consumer Price Index). Here’s how they define CPI: “The consumer price index (CPI) is a measure of the average change in the prices paid by urban consumers for a fixed market basket of goods and services. The CPI is based on prices of food, clothing, shelter, fuel, drugs, transportation fares, doctors’ and dentists’ fees, and other goods and services that people buy for day-to-day living. The quantity and quality of these items are kept essentially unchanged between major revisions so that only price changes will be measured. All taxes directly associated with the purchase and use of items are included in the index.”

As far as recent data, December’s core CPI (released Jan 12th) showed a .3% rise over November’s, exactly matching economists’ expectations. The “year over year” core CPI came in at 5.7%, also as expected. Note that while both are still well over the Fed’s 2% inflation target, they’re a considerable improvement from last fall’s historically high inflation data. This is the third consecutive month of reassuringly lowering inflation and may help assuage the Federal Reserve’s inflation concerns. Rates dropped slightly on the news, to their best levels in 4 months. As you can see from this one-year chart of 30-year fixed mortgage rates, we’re still a LONG way from last year’s rates, but at least we’re trending in the right direction!

If mortgage rates change constantly, why do I get advertisements from lenders showing highly attractive interest rates? Wouldn’t the advertised rate be obsolete before I even get the mailer?

Great observation! Short answer, yes, rates do change continually, and any mortgage advertisement that includes a rate is suspect for several reasons. In addition to rates changing daily, there are myriad factors that impact individual loans’ pricing: loan size, credit score, equity, property type, loan purpose, and (seemingly) the moon’s phase. When a lender advertises a rate, it’s based on certain assumptions which may not apply to your loan, such as 60% equity, 800 credit scores, loan sizes of 500K or above, etc. Just because a certain rate is theoretically available to SOME borrowers doesn’t mean it is for all! Bottom line, any rate quote that isn’t current or doesn’t accurately factor in the adjustments for your specific loan should not be relied on.

How is the number of new mortgages these days compared with the past few years? Seems like it should be lower, since rates were so low for most of the past 3 years.

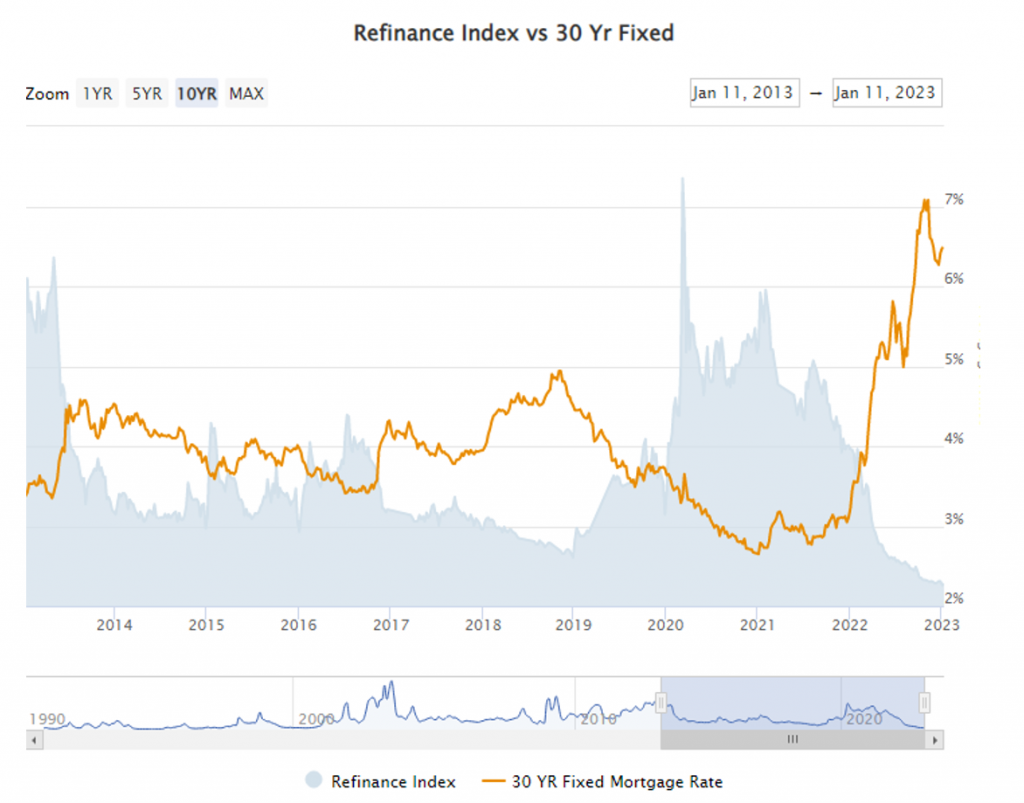

Lower is certainly one way to put it! Per Mortgage News Daily, “The Refinance Index rose 5 percent from the previous week but was 86 percent lower than the same week one year ago. Purchase loan activity was 44 percent lower than the same week one year ago.” Yikes! Here’s a chart showing interest rates and the number of refinance closings for the last 10 years:

The yellow line shows the prevailing 30-year fixed mortgage rate, and the gray field indicates the refinance index (higher means more loans!). As of today, refinances only account for 30% of new mortgages, compared with a significantly higher portion during the record low interest rates we saw for most of 2020-2022.

PMI and Credit Scores

Does PMI costs vary from lender to lender?

PMI cost (much like mortgage rates) is highly dependent on many factors. In fact, PMI companies consider more risk factors that mortgages do, including debt ratios, the number of borrowers, and whether they are self-employed (none of which impact a loan’s interest rate). Let’s compare the PMI costs for a 30-year fixed loan of $300,000, based on a 10% down payment on a single-family home:

Scenario A: 2 borrowers, neither self-employed, with low debt ratios and 760 mid credit scores would pay a monthly PMI cost of $52.50. While that’s a significant cost, it would be unlikely to deter home buyers from purchasing their dream home (or qualifying to do so).

Scenario B: 1 borrower, self-employed, with elevated debt ratios and a 639 mid credit score would pay a staggering $480/month PMI! That’s absolutely going to impact any borrower!

It’s also vital not to overlook the fact that the interest rates for these scenarios will also be quite different, even though debt ratios/self-employment and the number of borrowers aren’t pricing factors for mortgages. Fannie Mae and Freddie Mac have pricing adjustments (once again, based on perceived risk factors) that apply to loans with terms greater than 180 months. In our example, the pricing difference is 3%, which translates to $9,000 more costs for Scenario B’s borrower, or a significantly higher rate, likely up to 2% higher!

Since Credit Score Impacts PMI, what are the best ways for someone to improve their credit scores?

The bottom line is don’t make payments over 30 days late on any credit accounts, minimize credit inquiries and new accounts, have a mix of installment, mortgage, and revolving debt, keep the balances on your revolving accounts under 30% of their limits, and avoid all charge offs or collection accounts. As you might expect, foreclosures and bankruptcies are by far the “worst” adverse credit events for credit scores.

Most credit vendors have “what if” simulators which lenders can use to model how changes to credit profiles (such as lower credit card balances) will impact credit scores. If your loan officer mentions your scores are affecting the pricing for your loan or PMI, ask if he can run a “what if” projection to help you most effectively raise your credit scores. Fun fact, most pricing factors are based on 20-point credit score buckets (620, 640, 660, 680, 700, etc.), so if your current score is 699, you’d only need to raise it 1 point to move to the next higher/better priced bucket.

Answers to Homebuyers’ Questions

Do Lenders Sell My Information After Applying for a Mortgage?

“Here’s a weird one for you. I applied for a mortgage recently, and minutes after I did so, I started getting calls, texts, and emails from lenders I’d never heard of, saying they were ‘following up’ on my application. Surely my loan officer didn’t sell my info to his competitors, right? Is this legal? I certainly wasn’t expecting to be inundated by unknown lenders just because a bank pulled my credit!”

Ah, the joy of “trigger leads”!

What Are Trigger Leads?

All credit inquiries are not the same. Credit bureaus categorize those inquiries and sell consumers’ info to competing lenders. For example, a mortgage lender can purchase lists of mortgage credit inquiries that meet certain criteria (say, scores over 700) from Experian, Equifax, and Transunion. Surprisingly, the process is legal, although most lenders (and every borrower the author has ever spoken to) find trigger leads a dubious and deceptive practice. The key thing to remember is that you’re under no obligation to engage with these lenders and that they don’t know the details of your situation.

This is a lot to take in, navigate the crazy mortgage world by contacting a loan officer

Your loan officer should be a reliable, informed resource for you. If you haven’t already asked any questions that came to your mind (and have gotten comprehensible answers), it’s certainly best to bring them up early in the process. If the first answer you get isn’t clear, don’t simply nod and move on, ask again. The best loan officers proactively bring up all information pertinent to their borrowers, but there’s areas that need clarification on every loan. The choice is yours on how much you personally want, some borrowers want to know all the fine details on things like PMI pricing, while others just want to know their rate and where to sign. In either case, you’re the client, and should get as much/as little info as you personally desire.

Thanks for reading this edition of the Homesite Direct Mortgage Blog, and happy mortgage hunting!