As always, our goal is to provide tips for successfully navigating the mortgage process and to educate our readers on mortgage rates, the factors impacting them, and how to evaluate loan options. Please let us know if you have any questions for one of our loan experts!

I’m a first-time home buyer in Michigan. It’s tough saving for my down payment, and I’m hoping to move later this year. Are there options for buying with less than 3.5% down?

As we’ve previously discussed, FHA loans require a minimum down payment of 3.5% (which can either be the borrower’s funds or a gift from a family member) and VA loans for eligible veterans have no down payment requirements. There are also down payment assistance programs, such as DPA, which may be a great option for you.

Things to keep in mind on DPA programs:

- Most states have some manner of DPA available, with widely varying guidelines. It’s crucial to work with a lender who regularly originates DPA loans in your area. You want a specialist here, not Joe Loan Officer who works in a call center and has never written a DPA loan. In Michigan, this would be the MSHDC program, which will loan eligible borrowers up to $10,000 towards their down payment or closing costs. Homesite Direct regularly closes MSHDC loans, and we’re glad to discuss how they might help you.

- There are also some approved national DPA programs, which allow a homebuyer to borrow the 3.5% down payment, as a separate loan from the primary mortgage and slightly higher interest rate. Homesite Direct also participates in this 0% down program.

Are DPA Programs really that simple?

“Simple” and DPA are typically not found in the same sentence! There are specific guidelines for each different program including income restrictions (“don’t earn too much!), debt-to-income caps (“don’t owe too much!), credit scores, appraisal protocols, and funds’ reservation process. Just because you’re approved for an FHA loan with the normal down payment doesn’t mean you’ll qualify when adding a DPA program. The DPA loan approval may not start until your primary loan is approved, so the overall loan process may be impacted. It can be a daunting process, especially for an inexperienced lender. THIS is why working with a DPA specialist loan officer is a must. The last thing you want is to have your closing delayed (or denied!) due to your lender’s inexperience in closing the specific DPA loan you’re using.

Interest Rates & Inflation

What have interest rates been doing lately? Is inflation coming down?

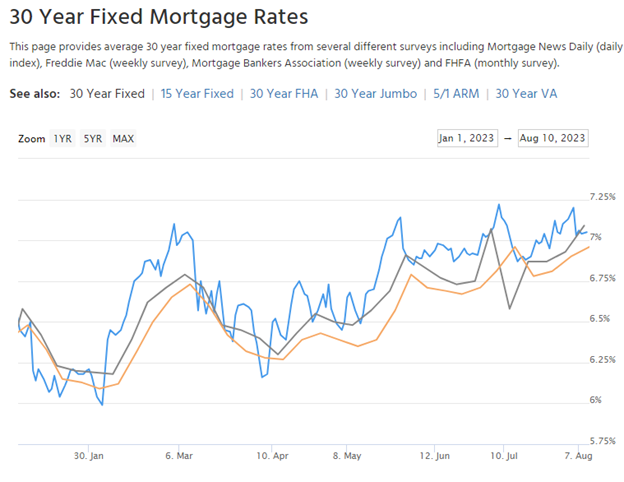

As the following chart, (courtesy, as always of MortgageNewsDaily.com) shows, 30-year fixed mortgage rates remain slightly above 7%. The blue line is Mortgage News Daily’s average rate compilation from leading lenders, and typically the most accurate. The orange line is Freddie Mac’s weekly rate survey, which we’ve previously discussed is often outdated before it’s even released, and the black line is weekly data from the Mortgage Banker Association.

While inflation (the most significant driver of mortgage rates) has slowed in recent months, it remains well above the Federal Reserve’s 2% target. Until prices stabilize, it’s unlikely mortgage rates will decline as much as borrowers, realtors, and lenders would like.

Should I wait to buy a new home, since rates are so much higher than they were just a couple of years ago?

We’ve seen many folks take that attitude over the years……typically with suboptimal results. “I’ll buy a house when I can get a 4% mortgage”, or “My buddy got 2.75% when he refinanced in October 2020, so I’ll hang on to my 7% mortgage until I can get a rate in the 2’s”. While it’s only human nature to HOPE for your preferred outcome, basing a move to a home that better suits your family’s needs (or a mortgage that improves your financial outlook) on an arbitrary interest rate goal accomplishes nothing. Don’t forget, rental costs (unless you live in Mom’s basement) continue to rise too!

My realtor keeps saying I can always refinance to save money later, but how would I know if it’s worth it?

THIS is a great question! As is often the case, there’s multiple factors to consider here. You may have heard some version of “it’s only worth refinancing if you drop your rate by at least 1%”. Yes, rate reduction is the biggest factor in most refinances, but there’s other factors to consider as well! Let’s look at some of them:

Where do I live?

Refinance costs vary WIDELY by state. Per Core Logic (a leading housing data firm), the average cost of a 2021 refinance in New York, including taxes, was an eye-popping $10,084. The least expensive states to refinance (Indiana and Missouri) were under $1500! It’s important to remember that individual loan costs vary, depending on their details, but, in general, homeowners refinancing in high-cost states will need a larger rate reduction than those in low-cost states.

How much do I owe?

If you owe $600,000 on your loan, reducing your rate by .5% could lower the payment by $180. In low-cost states, that may certainly be a benefit. If you owe $60,000, lowering your rate by 1% would only reduce the payment by $36. It’s unlikely most homeowners will consider that a significant improvement. The larger your loan size, the more your interest rate matters.

Am I paying PMI?

If so, how much is it? If you didn’t put 20% down on your home purchase (or have 20% equity when refinancing), it’s likely you’re paying PMI. As a reminder, PMI is insurance that protects lenders against loss when homeowners with minimal equity default on their loans. If you now have at least 20% equity, refinancing should eliminate your PMI costs, so dig out your mortgage statement to see how much you’re paying! As with interest rates, PMI costs are highly dependent on multiple factors. Eliminating it AND reducing your interest rate would be two benefits instead of one!

What other debt am I carrying?

Do I have enough equity to pay off some higher interest obligations? It’s certainly possible that refinancing would be a benefit even if the interest rate stays the same! Yes, that may sound crazy, but if you’re carrying 80K in credit card debt at 24% interest and can combine it with your mortgage, consider refinancing. This presumes, of course, you have adequate equity to cover the increased loan size, and are responsible enough to not end up with 80K of debt at 24% again!

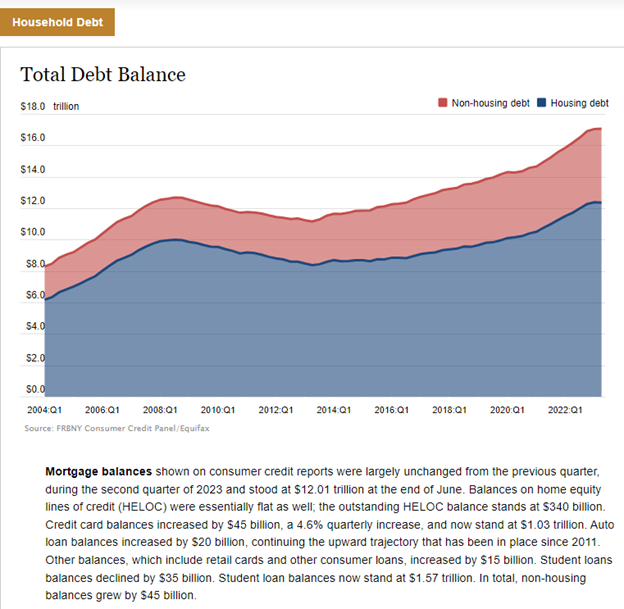

Speaking of debt, the New York Federal Reserve just issued its 2nd quarter report on US consumer debt. Outstanding US credit card balances topped $1,000,000,000,000 (yup, that’s a TRILLION!). Time to put that plastic away, especially since credit card interest rates have risen rapidly as the Federal Reserve hiked its overnight rate. Bankrate.com shows the average credit card interest rate is now 20.53%! To add insult to injury, federal student loan repayments are scheduled to resume this October.