As always, our goal is to inform and educate our readers on mortgage rates, the factors impacting them, and provide tips for successfully navigating the mortgage process.

Escrow Accounts for Mortgages

“I’m getting ready to buy my first house, and the loan officer wants to know whether I will ‘escrow’ my taxes and insurance. What in the world does that mean, and should I?”

Great question, thanks for asking. “Escrowing” in this sense means paying your homeowners insurance and taxes monthly, as part of your mortgage payment. Your loan servicer would then disburse (pay) the taxes/insurance on your behalf as they become due. Most borrowers opt to escrow, since it eliminates the need to pay property taxes and insurance in lump sums. Lenders typically require borrowers to escrow taxes/insurance unless they put down 20%+ on a purchase, or have 20%+ equity when doing a refinance. Note, there can be small, one time costs for not escrowing (typically referred to as “waiving escrows.” In most cases, the cost is .25% of the loan size, which amounts to $750 on a $300,000 loan. The waiver cost is based on loan size, rather than purchase price. Some states and loan programs may have lower/no escrow waiver costs, so ask your lender if any apply in your case.

“What would be the advantage of waiving escrows, and is it worth paying money to do so?”

That answer varies by individual circumstances, but in general, people are more likely to waive escrows if they have ample reserve funds for taxes and insurance, if they get annual bonuses around the time their taxes are due, or if they feel they can make money investing the escrow funds rather than having their servicer hold the money until taxes/insurance come due. With current bank interest rates very low (even after recent Fed rate hikes), setting aside funds in a savings account won’t generate any appreciable return. “Is it worth paying money to waive them” is a question we’ve been asked many times over the years, and our answer is typically “no, not unless you have a great reason for doing so.”

“My taxes and insurance seem to go up every year, how does that work with an escrow account? What happens if there’s not enough money in escrow to pay them?”

This is a question virtually EVERYONE with an escrow account runs into. Yes, taxes and insurance go up more often than they drop! When escrow accounts are established, two extra months’ tax/insurance costs are added in, to allow servicers to pay those costs, even if they rise. Every year, servicers are required to conduct an “escrow analysis”, which reviews funds deposited into escrow accounts and disbursements for taxes/insurance. If you’re somewhat confused when you get your escrow analysis statement, don’t be depressed, you’re hardly alone! The goal is to always maintain that two month cushion referred to above. If the escrow account balance drops below that, you’ll have the option to either make a lump sum payment for the shortfall or pay it off in installments over the next 12 mortgage payments. It’s also critical to remember that even if you make the lump sum payment, your mortgage payment will rise to account for the higher taxes/insurance.

“I pay my mortgage through an auto-debit I set up through my checking account and local bank. Do I need to do anything if my escrow analysis results in a higher payment?”

Indeed, you do! It’s borrowers’ responsibility to adjust any ACH payments they’ve set up through their checking accounts when their payments change. Over the years, we’ve seen a number of times where this was overlooked, resulting in payments that were less than the amount due. Best case scenario, you might incur a late charge for making an inadequate payment, worst case (which we’ve seen) is a late mortgage payment reported on your credit! While both these are theoretically possible to correct by contacting your loan servicer, it’s vastly preferable to be proactive and adjust any ACH payments the moment you receive an escrow analysis notice. Another dependable solution is to pay your mortgage through your servicer’s website, rather than setting up an ACH through your bank account. The servicer’s website should always have the correct escrow amount shown, eliminating the possibility of an incorrect payment.

Current Mortgage Rate Trends and Common Questions

“You’ve talked a lot about inflation, any news there since your last edition?”

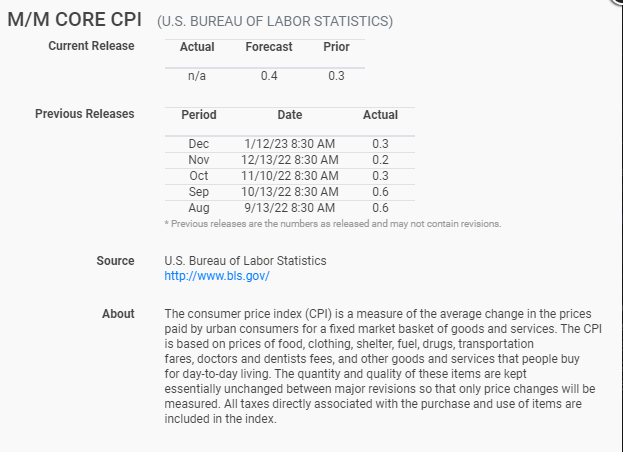

Indeed there is! The US Bureau of Labor Statistics releases its inflation data monthly, and in several categories. The most meaningful for mortgages is the “Month Over Month Core CPI Index”. CPI (Consumer Price Index) is government speak for “how much did consumers’ likely expenses rise compared with the preceding month?” When the Federal Reserve mentions inflation, this is typically what they are referencing. Since their stated goal is 2% annual inflation, monthly CPI should theoretically be .1%-.2%. What has Core CPI been doing lately? Let’s just say it’s a TAD above that!

The good news is that increases have dropped significantly from last September/August, which featured exceptionally high .6% readings. January’s forecast number was .4%, a slight increase over December’s .3%. The actual number? You guessed it, .4%.

So economists projections were virtually on target, does that mean rates dropped with the new data?

While January’s month over month CPI data did come in as expected, other inflation metrics did not. Two “year over year CPI” measures were above expectations, and bond markets sold off/rates rose. Ten-year Treasury yields (the simplest proxy for mortgage rates) rose to their highest levels of the year, as shown below. All charts and data courtesy of MBSLive.net and MortgageNewsDaily.com, as usual.

If we move to a one-year chart, Treasury yield increases are even more apparent:

March 1, 2022 marked the end of the pandemic rate rally, coincidentally near its two year anniversary. Will we ever witness this again? While nothing is impossible, it’s far more likely we won’t! Treasury yields rising over 2% in a year is unprecedented, and it took a unique set of circumstances for that to happen.

“So what will rates do now? Should I lock my rate, or float it in case rates improve? I’m closing my purchase in April.”

Ah, loan officers’ favorite question, and one they have encountered many times. Borrowers hope for a simple answer, but simple isn’t always accurate. “It depends” is more appropriate. This discussion, which should happen on every loan, entails your risk tolerance (would you be more irked if you don’t lock and rates rise, or if you do lock and they drop?), and whether your debt ratios are close to allowable maximums (will you qualify for your loan at a higher rate?). The author typically asks borrowers whether they like to gamble. In most cases, put on those terms, the answer is no. If you’re losing sleep, watching CNBC non-stop, and frantically revising your budget as rates rise, the answer should definitely be no.

If I lock my rate and rates improve, I can just ask my lender to redo my lock at the new rate, right?

Another question borrowers often ask, and once again, there’s no single answer. Most lenders have some manner of “renegotiation policy”, meaning if rates improve dramatically, locked loans MAY be eligible for a portion of the improvement. These policies vary widely by lender, so be sure to ask your loan officer about his/her firm’s renegotiation policy. In any case, improving the rate on a locked loan happens infrequently, at best. Remember, if rates worsen after you lock, your loan officer won’t tell you “Hey, rates rose, so we have to increase yours, even though we said we locked it.” A rate lock applies whether rates rise or fall! As always, it’s vital to remember that mortgages are both a product and a service. The “product” is the actual loan, interest rate, and costs. The “service” (which varies far more, in most cases, than the “product”) is your loan officer’s expertise, dedication, and accessibility, his operations staff’s efficiency, and the overall ability to deliver a drama-free loan that closes as planned, without delays or concerns.

“But isn’t the lowest rate always the best deal? Why wouldn’t I just look online, find the absolute lowest rate advertised, and use that lender?”

Even disregarding the “service” aspect we discussed above, the “lowest rate” is often NOT the best deal. If your loan doesn’t close on time (or at all!), the rate is hardly critical. If that rate requires significant additional upfront costs (whether included in the loan on a refinance or paid at closing), other questions need to be addressed. How long will you be in your house? The longer you’ll stay there, the greater the benefit of a lower rate. How much are refinance costs in your state? Remember, buying the rate down with higher initial closing costs reduces your future refinance opportunities. If you’re in a low-cost state, a typical refinance might entail a $2000-$3000 cost, making refinancing a viable option. If you’re in a high-cost state (think FL, NY among others), refinancing could cost several times that, and you’d need a larger improvement to benefit. Lastly, just because a rate is advertised doesn’t mean it’s accurate. Mortgage rates change daily (or even during the day), and nothing other than a locked Loan Estimate guarantees your rate and costs.

Thanks for reading this edition of the Homesite Direct Mortgage Blog, and happy mortgage hunting!